(Bloomberg) — Asian shares adopted US equities decrease as continuous shifts in US President Donald Trump’s method to tariffs on commerce companions whipped up market uncertainty and dented confidence within the financial outlook.

Most Learn from Bloomberg

Shares in Australia and Japan tumbled greater than 1.5% whereas European equity-index futures additionally fell after declines on Wall Road. An index of the greenback fell for a fifth session, its longest shedding streak in virtually a 12 months. Bitcoin fell as particulars of a US strategic reserve underwhelmed.

China emerged as a vibrant spot with a gauge of Chinese language shares in Hong Kong touching the best stage since November 2021.

Merchants pointed to uncertainty over Trump’s tariffs. US shares didn’t stage a rebound even after a call by Trump to delay levies on Mexican and Canadian items coated by the North American commerce deal, underscoring the delicate urge for food for threat. Monetary markets have whipsawed this week as traders take care of geopolitical uncertainty and conflicting alerts from the US concerning the levies.

“Confusion reigns across the Trump Administration coverage agenda,” stated Chris Weston, head of analysis for Pepperstone Group. “Whereas there are few indicators of panic, funds and fast-money accounts minimize fairness threat.”

Wall Road strategists have been debating whether or not the Trump administration can be swayed on its tariff plans by a decline in equities. The pondering being that Trump will ditch insurance policies if the inventory market — which he touts as a report card — drops and rattles traders. Varied companies even mapped out how a lot ache Trump might tolerate within the S&P 500 Index earlier than retreating. That index stage turned generally known as “the Trump put,” in reference to a put possibility.

To date, Trump has given little indication he’ll change course. The president downplayed the response to the newest developments, saying “I’m not even wanting on the market.” That adopted his feedback to Congress earlier this week that levies will trigger “just a little disturbance, however we’re OK with that. It received’t be a lot.”

Get the Markets Day by day publication to be taught what’s shifting shares, bonds, currencies and commodities.

European-equity index futures fell as a lot as 0.9% throughout Asian buying and selling. Contracts for S&P 500 moved up 0.3% after US chipmaker Broadcom Inc.’s upbeat income forecast reassured traders that spending on artificial-intelligence computing remained ongoing, pushing its shares round 13% larger in after-market buying and selling.

Treasuries have been barely larger Friday after a muted session on Thursday. The Mexican peso and the Canadian greenback rose on information of the potential tariff reprieve.

On Thursday, Trump delayed levies on items coated by the North American commerce deal from the 2 international locations till April 2. Later feedback from Treasury Secretary Scott Bessent all however confirmed tariffs shall be coming. Bessent rejected the concept tariff hikes will ignite a brand new wave of inflation, and advised that the Federal Reserve must view them as having a one-time impression.

European shares have superior virtually 10% this 12 months, as price cuts and Germany’s plan to lift protection spending enhance the market. In the meantime, a gauge of Chinese language shares listed in Hong Kong has surged virtually 23% up to now this 12 months on optimism over the nation’s artificial-intelligence adoption drive and anticipated stimulus from Beijing.

Whereas the creation of the Bitcoin-specific reserve fulfills a promise Trump made on the marketing campaign path, the main points fell in need of trade expectations.

Bitcoin dropped as a lot as 5.7% earlier than paring a number of the losses. Whereas the creation of the Bitcoin-specific reserve fulfilled a promise Trump made on the marketing campaign path, the main points fell in need of trade expectations.

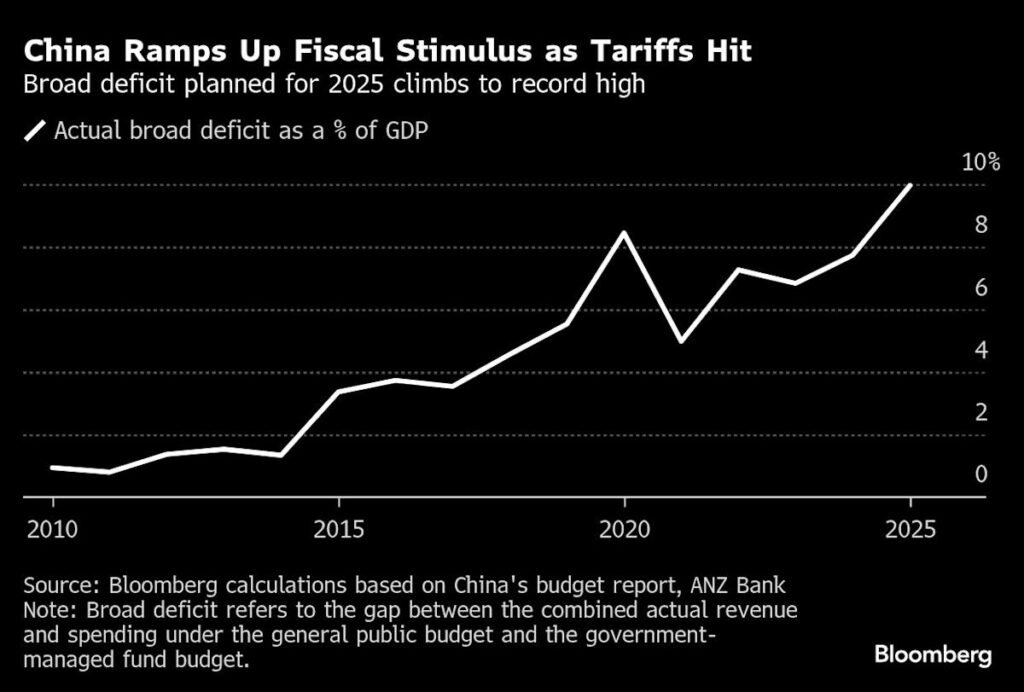

In Asia, China’s central authorities has ample fiscal coverage instruments and area to reply to attainable home and exterior challenges, Finance Minister Lan Fo’an stated Thursday on the sidelines of the annual legislative session. The Folks’s Financial institution of China will implement a reasonably unfastened financial coverage, Governor Pan Gongsheng stated, repeating an earlier pledge to chop rates of interest and decrease the reserve requirement ratio for lenders at “an applicable time.”

China’s exports reached a file up to now this 12 months as larger US tariffs, and the specter of extra to return, drove frontloading of shipments.

Upcoming US nonfarm payrolls information on Friday could assist merchants establish the trail forward for rates of interest. The report from the Bureau of Labor Statistics will present an replace about momentum within the labor market that’s been the important thing assist — not less than till January — of family spending and the economic system.

Fed Chair Jerome Powell is slated to talk at a financial coverage discussion board Friday afternoon. Policymakers subsequent meet March 18-19 and so they’re anticipated to carry rates of interest regular as they gauge the labor market and inflation traits in addition to current authorities coverage shifts.

In the meantime, Fed Reserve Governor Christopher Waller stated he wouldn’t assist reducing rates of interest in March, however sees room to chop two, or probably three, occasions this 12 months.

“If the labor market, all the things, appears to be holding, then you may simply form of keep watch over inflation,” Waller stated Thursday on the Wall Road Journal CFO Community Summit. “Should you suppose it’s shifting again in direction of goal, you can begin reducing charges. I wouldn’t say on the subsequent assembly, however might actually see going ahead.”

In commodities, oil was on observe for the largest weekly decline since October whereas gold was on observe for a acquire as merchants sought havens.

Key occasions this week:

-

Eurozone GDP, Friday

-

US jobs report, Friday

-

Fed Chair Jerome Powell provides keynote speech at an occasion in New York hosted by College of Chicago Sales space College of Enterprise, Friday

-

Fed’s John Williams, Michelle Bowman and Adriana Kugler communicate, Friday

Among the important strikes in markets:

Shares

-

S&P 500 futures rose 0.2% as of two:23 p.m. Tokyo time

-

S&P/ASX 200 futures fell 2%

-

Japan’s Topix fell 1.6%

-

Hong Kong’s Cling Seng rose 1.1%

-

The Shanghai Composite rose 0.2%

-

Euro Stoxx 50 futures fell 0.7%

Currencies

-

The Bloomberg Greenback Spot Index was little modified

-

The euro rose 0.2% to $1.0809

-

The Japanese yen rose 0.2% to 147.69 per greenback

-

The offshore yuan was little modified at 7.2423 per greenback

Cryptocurrencies

-

Bitcoin fell 2% to $88,066.18

-

Ether fell 2% to $2,168.72

Bonds

-

The yield on 10-year Treasuries declined three foundation factors to 4.25%

-

Japan’s 10-year yield superior one foundation level to 1.525%

-

Australia’s 10-year yield declined eight foundation factors to 4.40%

Commodities

This story was produced with the help of Bloomberg Automation.

Most Learn from Bloomberg Businessweek

©2025 Bloomberg L.P.