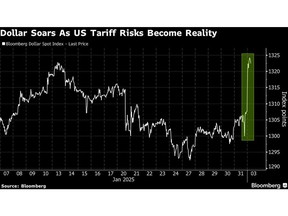

Wall Avenue Backs the Greenback’s Wild Rally To Collect Steam

Wall Avenue banks together with Goldman Sachs Group Inc. and JPMorgan Chase & Co. assume there’s nonetheless loads of cash to be made shopping for the greenback, even after US President Donald Trump’s tariff-push despatched the buck hovering.

Article content material

(Bloomberg) — Wall Avenue banks together with Goldman Sachs Group Inc. and JPMorgan Chase & Co. assume there’s nonetheless loads of cash to be made shopping for the greenback, even after US President Donald Trump’s tariff-push despatched the buck hovering.

Article content material

Article content material

Amongst their trades: Goldman Sachs expects the greenback to interrupt parity towards the euro. JPMorgan predicts the US foreign money to purchase round 1.50 Canadian {dollars} for the primary time in a era.

Commercial 2

Article content material

Virtually each asset class offered off after Trump mentioned he’ll slap tariffs towards Canada, China and Mexico from Tuesday, leaving the greenback the unanimous winner. Though many merchants had been braced for tariffs earlier than Trump’s inauguration, his initially mushy tone on China fueled bets that he would possibly maintain fireplace, undermining the greenback rally. These hopes have proved brief lived.

“Tariffs have a powerful, direct and unambiguous influence on alternate charges, in contrast to different asset courses,” Goldman Sachs strategists together with Dominic Wilson wrote in a be aware, noting dangers of an 8% to 10% fall within the euro in a world tariff situation.

Underpinning the greenback’s enchantment is the belief {that a} commerce battle will underpin US inflation and thus rates of interest in addition to hurting overseas economies greater than the US and enhancing its enchantment as a haven at a time of threat.

The greenback’s march larger on Monday pushed the loonie to its weakest stage in additional than 20 years, whereas the Mexican peso, the euro and the Australian greenback fell to multi-year lows.

Going lengthy {dollars} has develop into probably the most in style trades in world markets just lately. Leveraged funds are extra bullish on the foreign money than they’ve been since Sept. 2018, in accordance with Commodity Futures Buying and selling Fee knowledge compiled by Bloomberg.

Article content material

Commercial 3

Article content material

Protected Haven Performs

JPMorgan recommends being optimistic in the direction of the buck and yen positions towards currencies of economies focused by tariffs, such because the Canadian greenback and euro. It mentioned the instant introduction of 25% tariffs might weaken the loonie so far as 1.58 per greenback, whereas the greenback might hit 23.50 towards the Mexican peso and seven.37 towards the offshore yuan.

Though the eurozone was spared from Trump’s weekend tariff bulletins, he has mentioned tariffs towards the buying and selling bloc “will certainly occur.”

Goldman Sachs sees the greenback strengthening towards friends just like the Chinese language yuan as its standing as a safe-haven foreign money burnishes its enchantment. It reckons the onshore yuan might weaken so far as 7.50 per greenback.

Wells Fargo & Co additionally likes the greenback and the yen primarily based on protected haven enchantment, and is positioning for a weaker Mexican peso and yuan, mentioned Brendan McKenna, an economist on the financial institution. He mentioned markets should still be “critically underpricing” the probability of tariffs.

Citigroup Inc. strategists are extra cautious. They see a stronger US foreign money within the short-term, however mentioned this could possibly be reversed as markets digest the influence of tariffs on the world’s largest financial system.

Commercial 4

Article content material

The greenback’s ciimb is fueling questions on simply how far the rally might go, with 2022 peaks the subsequent potential pitstop. However there are complicating components for merchants.

Tariff spats are often assumed by economists to be lose-lose propositions for the nations concerned, rising the chance of volatility. There’s additionally an opportunity that Trump reverses course, after a historical past of unpredictability throughout his first time period.

What Bloomberg Strategists Say…

“Given some indicators that merchants nonetheless see the potential that President Trump’s tariffs will show to be short-lived negotiating techniques, the US foreign money has loads of room to climb considerably additional the longer the commerce confrontations prolong.”

Garfield Reynolds, Markets Reside strategist

“When the financial penalties hit the US, for instance, then you definately begin to see issues might reverse,” mentioned Ken Peng, head of funding technique for Asia at Citigroup wealth division in Hong Kong. “I’d relatively be a volatility purchaser for the time being, relatively than a directional wager.”

Canada has already fired again with its personal 25% tariffs on the US after Trump’s preliminary shot, whereas Mexico and China have vowed to retaliate. The European Union, in the meantime, has promised to “reply firmly” if the US imposes tariffs.

Article content material