Treasuries ‘Dying Spiral’ Threat Is Brushed Apart by Overseas Funds

Whether or not you’re talking with Europe’s largest cash supervisor, Australia’s big pension funds, or a cash-rich insurer in Japan, there’s a convincing message you’ll hear in the case of US Treasuries: They’re nonetheless onerous to beat.

Article content material

(Bloomberg) — Whether or not you’re talking with Europe’s largest cash supervisor, Australia’s big pension funds, or a cash-rich insurer in Japan, there’s a convincing message you’ll hear in the case of US Treasuries: They’re nonetheless onerous to beat.

Article content material

Article content material

4 months since incoming Vice President JD Vance stated he was involved Treasuries face a potential “dying spiral” if bond vigilantes search to drive up yields, corporations together with Authorized & Basic Funding Administration and Amundi SA say they’re prepared to offer the brand new administration the good thing about the doubt.

Commercial 2

Article content material

There are many causes for world funds to purchase at the same time as Treasuries are mired in an historic bear market. The securities supply an enormous yield premium over bonds in locations akin to Japan and Taiwan, whereas Australia’s quickly rising pension business is including Treasuries each month due to the market’s depth and liquidity. The US additionally appears to be like a safer guess than some European sovereign markets which can be grappling with fiscal issues of their very own.

Traders have additionally taken consolation in Trump’s nomination of hedge fund supervisor Scott Bessent to be his Treasury secretary, overseeing the federal government’s debt gross sales. Bessent, whose affirmation listening to earlier than the Senate is scheduled for Thursday, goals to slash the deficit as a share of gross home product by tax cuts, spending restraint, deregulation and low cost power.

“On the chance of a ‘dying spiral,’ any bond market can change into caught in a cycle of mutually reinforcing larger yields and better debt projections,” stated Chris Jeffery, head of macro technique, asset administration at Authorized & Basic Funding, the UK’s largest asset supervisor. However, “the incoming Treasury Secretary has talked about aiming for a 3% deficit in 2028. Bond traders don’t have any cause to go on strike if the Federal authorities adopts such aspirations.”

Article content material

Commercial 3

Article content material

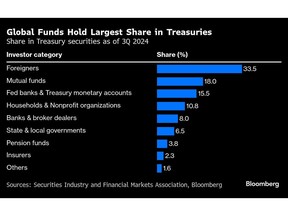

The stance of abroad traders towards Treasuries is extra vital than ever. Overseas funds held $7.33 trillion of long-term US debt on the finish of October, a few third of the excellent quantity, and slightly below the report $7.43 trillion they owned in September, primarily based on the most recent US authorities information.

On the coronary heart of the controversy about whether or not to maintain shopping for Treasuries is the biggest US federal deficit exterior of utmost intervals such because the pandemic and the worldwide monetary disaster. There are a selection of indicators that traders are getting skittish. Benchmark US-year 10 yields have jumped greater than a proportion level from September’s low, and are threatening to as soon as once more breach the important thing psychological degree of 5%.

Yields on 10-year notes fell 14 foundation factors to 4.65% on Wednesday in response to benign US inflation information, the primary drop in 9 days.

Traders in Japan — the largest abroad holders of Treasuries — are conscious of the rising dangers however stay keen patrons.

“The dominant view in markets is that the US Treasury market is just too giant and liquid and US seigniorage too deeply entrenched to undermine the central function of Treasuries in world central financial institution reserves,” stated Naomi Fink, chief world strategist at Nikko Asset Administration in Tokyo.

Commercial 4

Article content material

“In our central state of affairs, we anticipate the adjustment in US Treasury yields to proceed in an orderly vogue. Nevertheless, the likelihood of a extra disruptive adjustment, whereas nonetheless small, has elevated in our view,” she stated.

One cause Japanese traders favor Treasuries is that they supply publicity to the all-conquering greenback. Funds within the nation would have reaped a return of 12% on their unhedged Treasury investments in 2024, with a minimum of 11.5% of that as a result of buck’s appreciation.

View From Europe

European funds are additionally largely optimistic, saying any spike up in Treasury yields is unlikely, particularly as Trump seems conscious of the necessity to preserve world traders onside.

Markets are anticipating the brand new administration will imply larger US progress and inflation, which has prompted the yield curve to steepen, however that’s truly making Treasuries extra alluring, stated Anne Beaudu, deputy head of worldwide mixture methods at Amundi in Paris.

“US bonds seem extra enticing at these ranges, as rising yields will finally weigh on progress prospects or dangerous asset efficiency and the bar for climbing charges stays very excessive,” she stated. “However the market will definitely stay cautious till we’ve got extra readability on Trump’s agenda.”

Commercial 5

Article content material

No less than some world funds are cautious on Treasuries because the US debt pile grows.

The price range deficit burgeoned to $1.83 trillion for the fiscal 12 months ending September, in line with the most recent information printed in October. The shortfall is forecast to swell additional if Trump carries out his pledges to chop taxes and increase spending.

“The curve will stay very steep with numerous new issuance coming to the market, and that once more feeds adverse into Treasuries,” stated Kaspar Hense, senior portfolio supervisor at RBC Bluebay Asset Administration in London. There’s at the least some likelihood of spike in US yields, just like that seen within the UK throughout the tenure of Prime Minister Liz Truss in 2022, he stated.

The selloff in Treasuries in latest weeks although has satisfied BlueBay to pare again a few of its bets that 30-year 12 months yields will underperform two-year ones, the corporate stated this week.

‘No Higher Place’

Traders in China, the second-biggest abroad holders of US debt, view the prospect of a Treasury meltdown as marginal.

“Even when considerations over larger borrowing prices and monetary pressures within the US are official, the prospect for us to see a catastrophic collapse of the bond market is kind of low,” stated Ming Ming, chief economist in Beijing at Citic Securities Co., one in all China’s largest brokerages.

Commercial 6

Article content material

“If there’s any pointless volatility within the US bond market, the Fed nonetheless has loads of instruments to stabilize it and handle liquidity. That can assist ease pressures,” he stated.

Traders in Taiwan are additionally persevering with to place cash into US debt.

“The momentum has not slowed regardless of expectations for slower or smaller charge hikes and chatter across the ‘dying spiral,’ the truth is, we’re seeing cash persevering with to pour in as yields rise,” stated Julian Liu, chairman of Yuanta Securities Funding Belief, the island’s largest native asset supervisor.

“For many Taiwan’s traders, the conclusion might doubtless be that there’s no higher place to put money into.”

—With help from Jing Zhao, Masaki Kondo, Mia Glass, Alice Atkins, Betty Hou, Iris Ouyang, Chien-Hua Wan and Liz Capo McCormick.

Article content material