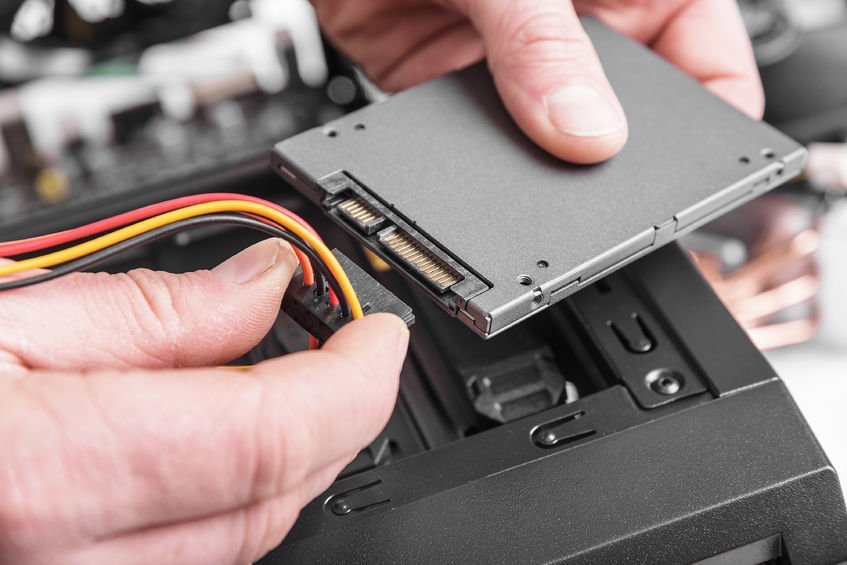

Western Digital (WDC) Named “High Choose,” Soars 14.6%

We just lately printed 10 Huge Names With Double-Digit Upsides. Western Digital Corp. (NASDAQ:WDC) is certainly one of final week’s prime performers.

Shares of Western Digital surged by 14.56 p.c week-on-week to the touch a brand new all-time excessive after Morgan Stanley named it as its “prime choose” throughout the sector.

On Friday, Western Digital Corp. (NASDAQ:WDC) touched a brand new 52-week excessive of $93.10, rallied on all days of the shortened buying and selling week, albeit the steepest bounce noticeably occurred on September 3 after the funding financial institution’s market report.

Copyright: believeinme33 / 123RF Inventory Photograph

This adopted a sequence of “constructive” conferences between Morgan Stanley and Western Digital Corp. (NASDAQ:WDC) that boosted the previous’s confidence within the latter’s know-how roadmap.

Moreover, the storage agency has demand visibility, as evidenced by non-cancellable buy orders and long-term agreements within the second half of 2026.

That is “the one most necessary knowledge level illustrating that [cloud service firms] are snug with WDC’s know-how roadmap,” it stated.

Morgan Stanley additionally gave Western Digital Corp. (NASDAQ:WDC) the next worth goal of $99 versus $92 beforehand, including that the value may breach the $125 mark in a bull case situation.

From its closing worth of $92.04 on Friday, the brand new worth targets marked upside potential of seven.56 p.c and 35.8 p.c, respectively.

Whereas we acknowledge the potential of WDC as an funding, our conviction lies within the perception that some AI shares maintain higher promise for delivering increased returns and have restricted draw back danger. If you’re in search of an especially low cost AI inventory that can be a significant beneficiary of Trump tariffs and onshoring, see our free report on the finest short-term AI inventory.

READ NEXT: 30 Shares That Ought to Double in 3 Years and 11 Hidden AI Shares to Purchase Proper Now.

Disclosure: None. This text is initially printed at Insider Monkey.