UK Firms Might Acquire Aggressive Benefit From Trump Tariffs

Donald Trump’s preferential therapy of British exports provides the nation’s corporations a aggressive benefit that might defend the financial system from the worst of Washington’s commerce battle, in keeping with economists.

Article content material

(Bloomberg) — Provide Traces is a day by day publication that tracks world commerce. Enroll right here.

Article content material

Article content material

Donald Trump’s preferential therapy of British exports provides the nation’s corporations a aggressive benefit that might defend the financial system from the worst of Washington’s commerce battle, in keeping with economists.

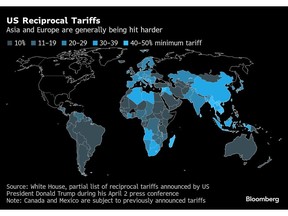

Trump put a ten% obligation on all imported UK items, the bottom price accessible, as a part of his “Liberation Day” tariffs on America’s buying and selling companions, a transfer that crashed markets and threatens to upend your entire world buying and selling system.

Commercial 2

Article content material

However consultants mentioned the UK is amongst these best-placed as a result of the decrease tariffs give its producers a aggressive benefit and the federal government is in a very good place to safe a cope with the US for additional reductions within the levies.

David Waine, managing director of ConMech, a specialist metal engineer within the north west of England, instructed BBC Radio on Thursday that whereas “for a lot of industries it’ll be fairly worrisome, for ourselves it presents a chance” as a result of ConMech’s merchandise will now be cheaper within the US than these of abroad rivals.

“We should always truly be extra aggressive within the US market than we’ve been for plenty of years,” he mentioned. Trump needs to construct up home US business however that may take a while and America will nonetheless want imports.

The federal government is in talks with the US a few focused commerce settlement to decrease the ten% baseline price or deliver the 25% tariff on UK metal and vehicles down towards 10%. Choices on the desk embody dropping UK tariffs on US agriculture, scrapping the digital companies tax on US tech corporations and agreeing new rules round expertise.

Article content material

Commercial 3

Article content material

Alan Winters, a commerce professional and emeritus professor on the College of Sussex, mentioned the direct impression of the tariffs on the UK can be small. “If somebody hits your rivals more durable than they hit you, you get a aggressive benefit,” he mentioned. “If we get a commerce settlement with the US we may even get good points.”

Sussex’s Centre of Inclusive Commerce Coverage estimated in a paper on Friday “modest losses for the UK” of 0.1%-0.3% from GDP. If the UK can strike a cope with the US, the financial system will “make a constructive acquire of 0.1%.” The US will “undergo greater than another nation” from its personal measures, the paper added.

Britain has “probably the greatest possibilities of coming away with a deal” that might see tariffs on UK items lowered attributable to its balanced commerce with the US and Prime Minister Keir Starmer’s strong relationship with the president, Mats Persson, head of macro technique at EY Parthenon, mentioned. “Within the quick time period, there may be a lot uncertainty however you’ll be able to see how the items would possibly finally fall that make the UK extra aggressive.”

‘Probably Advantageous’

Britain’s 10% levy makes it the most important items exporter on the earth to have the baseline tariff. China faces a 34% tariff and has retaliated in sort. EU nations have 20% and South East Asian exporters had been badly hit. Mexico and Canada had been excluded as separate preparations are in place.

Commercial 4

Article content material

Trump instructed reporters on Thursday he believed Starmer “was very completely satisfied about how we handled them on tariffs.”

Whereas recognizing the instant fallout shall be damaging, Raoul Ruparel, director of Boston Consulting Group’s Centre for Development, mentioned the relative impact of the preferential obligation “is doubtlessly advantageous and should have some positives for the UK, significantly if different nations retaliate and the UK doesn’t.”

Ruparel added that commerce diversion into the UK of products that may have gone to the US might deliver down costs and permit the Financial institution of England to chop rates of interest extra shortly. “In the mean time the tariffs appear to be being extra disinflationary than inflationary for the UK, that’s useful for dwelling requirements and borrowing prices,” he mentioned. “It’s not all unhealthy for the UK financial system.”

Markets responded to Trump’s tariffs by predicting that the BOE would lower charges thrice this yr, having beforehand anticipated simply two.

The Worldwide Financial Fund has warned of a “vital danger” to the world financial system and Bloomberg Economics has estimated that the direct impression of tariffs on UK exports may knock as a lot as 0.4% off GDP.

Persson mentioned there was “potential upside for some UK companies and the UK itself within the medium time period” however he cautioned that any potential good points may very well be blown away by a worldwide droop attributable to the commerce shock or ongoing uncertainty.

Article content material