UK borrowing overshoots expectations and retail gross sales dive earlier than Funds

Unlock the Editor’s Digest totally free

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

Worse than anticipated authorities borrowing numbers, a pointy slowdown in personal sector exercise and a dive in retail gross sales have underscored the delicate state of the UK financial system lower than every week earlier than chancellor Rachel Reeves’ tax-raising Funds.

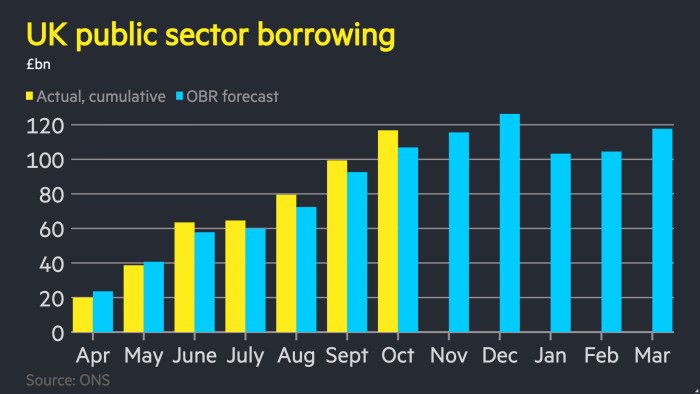

Friday’s report from the Workplace for Nationwide Statistics confirmed public sector borrowing was £17.4bn final month, in contrast with expectations of £15bn in a Reuters ballot of analysts.

Total, the Treasury has borrowed £116.8bn for the seven months of the fiscal 12 months so far, practically £10bn greater than the final forecast by the Workplace for Funds Accountability.

A separate launch from the ONS on Friday confirmed that British retail gross sales fell 1.1 per cent in October, a lot worse than anticipated.

Ruth Gregory at Capital Economics stated the figures, the final large financial releases earlier than the Funds, “paint a reasonably grim image” and famous the danger that “greater taxes within the Funds restrain retail spending over the essential festive interval and going into subsequent 12 months”.

A GfK shopper confidence printed earlier on Friday confirmed a fall of two factors to minus 19 in October, whereas enterprise exercise barely grew in November, in response to the S&P World/Cips flash UK PMI.

The chancellor is ready to extend taxes additional in Wednesday’s Funds as she seeks to fill a fiscal gap estimated at between £20bn and £30bn.

After elevating taxes by £40bn in final 12 months’s Funds, Reeves had vowed to not return for additional will increase. However the public funds have since deteriorated within the face of weak development and excessive borrowing prices.

Friday’s borrowing information — which additionally revised September’s determine barely right down to £19.89bn — reveals that the general public funds stay on an unsteady footing.

A few third of the deficit overshoot within the fiscal 12 months so far stems from greater than anticipated borrowing by native authorities, the Institute for Fiscal Research stated. Regardless of excessive inflation, each VAT and revenue tax receipts have remained barely beneath forecasts.

Whereas warning in opposition to over-interpreting month-to-month fluctuations, the IFS stated Friday’s figures “spotlight essential context for subsequent week’s Funds: uncertainty round tax revenues, pressures on public spending and stubbornly excessive prices of servicing authorities debt”.

Economists stated the uncertainty across the Funds had additionally contributed to the autumn in retail gross sales and sharp slowing in personal sector exercise.

The S&P World /Cips flash PMI, a measure of the manufacturing and providers sector, fell to 50.5 in November, beneath forecasts of 51.8, and down from 52.2 in October. The studying was simply above the 50 mark that indicated companies are increasing.

Thomas Pugh, chief economist at RSM UK, stated that the mix of information pointed to a “clear image of nervous customers and companies reining in exercise” forward of the Funds.

He added that the danger was “development fully stalls within the final quarter of the 12 months, particularly if the Funds goes badly”.

The larger than anticipated decline in retail gross sales in October was the primary month-to-month fall since Might, with gross sales at supermarkets, clothes and mail-order retailers all down.

Whereas some retailers attributed the slide to customers delaying their spending within the lead-up to Black Friday, Rob Wooden at Pantheon Macroeconomics stated that “the more and more chaotic run-up to the Funds has begun to weigh on shopper spending”.

Gilt traders have been on edge as they await particulars on how Reeves plans to curb borrowing after a late resolution to ditch plans to extend revenue tax.

Gilts gained following the releases, outperforming different main bond markets.

The ten-year yield was down 0.05 proportion factors at 4.54 per cent. Yields transfer inversely to costs. The pound was weaker in opposition to the greenback, down 0.1 per cent at $1.306.

The Funds is predicted to freeze private thresholds for longer and cap tax advantages from wage sacrifice schemes, along with measures to lift cash from costly houses and playing.

Reeves had ready the bottom for a rise in revenue tax charges earlier than altering course final week.

James Murray, chief secretary to the Treasury, stated: “We’re set to ship the biggest major deficit discount in each the G7 and G20 over the subsequent 5 years, to get borrowing prices down.”