Tennessee mother of seven thinks groceries are retaining her broke on a $150K earnings — however Dave Ramsey disagrees

Denise and her husband earn $150K a yr, don’t have any debt, and have constructed a large retirement fund — so why does cash nonetheless really feel tight?

With seven youngsters to lift, this Tennessee mother known as into The Ramsey Present [1] to get the consultants’ tackle her monetary scenario.

“We paid all the things off first, after which we had youngsters. And so we now have a large retirement fund, and it simply feels very unusual to nonetheless be… in a scenario the place my husband’s getting upset about cash after we’re presupposed to be doing that effectively on paper,” Denise stated. She goes on to say that she thinks groceries and insurance coverage bills are straining their finances.

When Denise requested if they may ever “save an excessive amount of,” Dave Ramsey believes the actual downside wasn’t the financial savings; it was the dearth of planning. “You are throwing cash in financial savings and hoping you possibly can reside with what’s left over, and when chaos hits, you dip again into the financial savings,” Ramsey stated.

When Ramsey dug deeper into Denise’s scenario, he found that the couple doesn’t have a strong finances arrange, which is an enormous purpose for the stress and “chaos” each month.

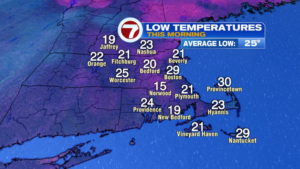

Having a finances is crucial, particularly with the unpredictable monetary panorama of immediately. Inflation continues to chop down shoppers’ buying energy, making on a regular basis necessities like meals, fuel, and utilities costlier than they had been even a yr in the past. In 2025, U.S. inflation is projected to go up by 3.1% in line with the Congressional Finances Workplace [2]. Because of this for a lot of households, like Denise’s, each greenback must stretch even additional.

A current Lending Tree survey confirmed that many Individuals have modified their grocery and eating out habits, reporting that 44% are shopping for extra generic manufacturers and 61% are careworn about having the ability to afford groceries [3].

On the similar time, increased rates of interest imply bank card balances, mortgages, and auto loans are costlier to hold. Having debt and never having a finances in place means extra stress.

Creating and following a finances offers you management over your funds. It helps households see precisely the place their cash goes and the place it may be adjusted. Budgets additionally power folks to deal with priorities like determining true wants from desires and ensuring to repay money owed first.