She Financed Her Daughter’s $27,000 Automotive And Now Needs A HELOC To Pay It Off. Dave Ramsey Requested, ‘Are You A Multimillionaire?’

Rachel from Sacramento, California, known as into “The Ramsey Present” with a monetary dilemma that she admitted was of her personal making. The 61-year-old defined she purchased her daughter a $27,000 automobile in September with the understanding that her daughter would refinance it into her personal identify as soon as her credit score improved. A 12 months later, the mortgage and insurance coverage stay in Rachel’s identify, and the state of affairs has snowballed.

“It’s nearly a 12 months she hasn’t accomplished that. She’s getting FasTrak tickets, that is like a toll bridge factor. And her insurance coverage just isn’t lined by anybody aside from mother. I really feel like I am able to do one thing drastic simply to repay the automobile and simply give it to her,” Rachel mentioned.

Do not Miss:

When requested concerning the numbers, she admitted all the things, together with the mortgage and registration, was in her identify. She described herself as “dummy me,” acknowledging the choice had backfired. Now, she’s contemplating tapping into her Social Safety early, utilizing a house fairness line of credit score, or cashing out a lump sum from her employer to resolve the debt.

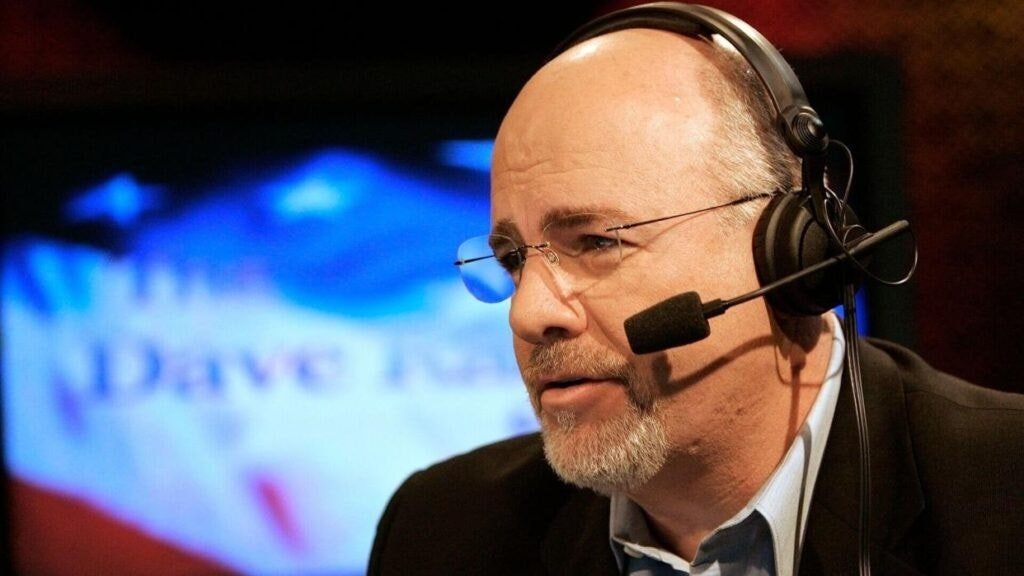

Private finance knowledgeable Dave Ramsey instructed her straight, “Candy woman, you made a mistake. Undo the error. Do not hold doing it.”

Ramsey emphasised that Rachel’s present of the automobile had not helped her daughter however as a substitute trapped her. “What you probably did was not a blessing to your daughter. You did not assist your daughter. You damage your daughter,” he mentioned. “You place her in a state of affairs the place she will be able to’t afford a automobile.”

Trending: An EA Co-Founder Shapes This VC Backed Market—Now You Can Put money into Gaming’s Subsequent Large Platform

Rachel argued that her daughter, a single mom with three youngsters, nonetheless wanted dependable transportation. Ramsey agreed however pushed again on the concept that it needed to be a $27,000 automobile. “She doesn’t want a $27,000 automobile, and she or he’s irresponsible, and she or he did not comply with via on what she mentioned. Honey, she will be able to get a $5,000 automobile. Single mother and father do it on a regular basis.”

When Rachel talked about presumably utilizing a HELOC or different funds to repay the stability, Ramsey requested, “Are you a multimillionaire?” When she replied no, he shut down the concept: “You do not have the cash to throw round $27,000, do you?”