Might Shopping for The Metals Firm At the moment Set You Up for Life?

-

The Metals Firm is making an attempt to mine polymetallic nodules from the Pacific seafloor.

-

These nodules are wealthy in nickel, cobalt, copper, and manganese.

-

The corporate lacks a business license, and the timeline for getting one is unknown.

The Metals Firm (NASDAQ: TMC) is a deep-sea mining exploration agency that wishes to hoover polymetallic nodules from the Pacific seafloor and switch them into battery-grade metals.

The corporate believes that if it could possibly safe permits quickly, it may start business manufacturing within the fourth quarter of 2027. It additionally believes it could possibly generate some engaging margins on the nodules in its possession. Certainly, a current feasibility research pegged its mixed mission worth at about $23.6 billion.

Taken collectively, these numbers sound spectacular, however additionally they increase the blunt query: Is TMC for actual, or is that this story extra of a mirage than a positive factor?

Let’s take a fast have a look at the information.

Let’s begin with the laborious reality.

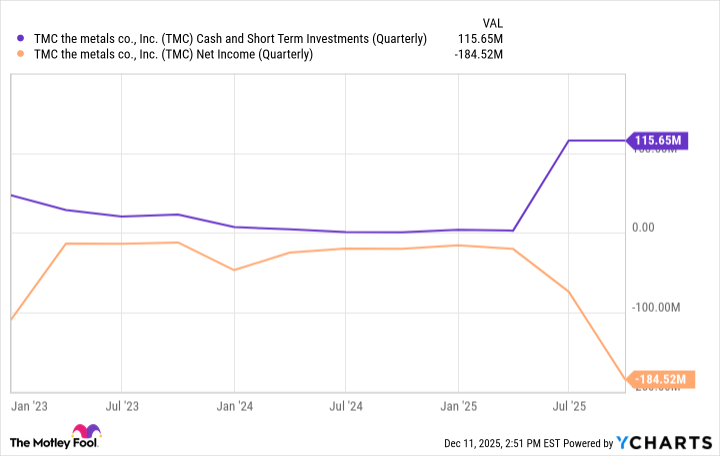

TMC continues to be pre-revenue, which means it is not bringing in cash, and it is burning vital money. It reported roughly $165 million in complete liquidity for the third quarter and a internet lack of about $185 million.

On high of that, no firm has ever operated a business deep-sea mission earlier than, and regulators are nonetheless arguing over the foundations. In the meantime, scientists and oceanographers are anxious that deep-sea mining may trigger irreversible injury to ocean life.

True, TMC has demonstrated in checks that its nodule collector can convey nodules up from the seafloor. However scaling that right into a commercially viable operation is a a lot more durable leap.

Different elements may derail TMC’s long-term potential, too, equivalent to a change in battery know-how or a slide in nickel and cobalt costs.

None of this implies TMC will not final as a enterprise, solely that it’s not a straight shot to riches. If the inventory does set you up for all times, the journey will possible be lengthy and bumpy, particularly in these early pre-revenue days.

For many buyers, that makes TMC a tiny place at most, sized as cash you may afford to lose. Extra conservative buyers will possible wish to look elsewhere for his or her subsequent funding.

Before you purchase inventory in TMC The Metals Firm, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and TMC The Metals Firm wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.