C.H. Robinson did two uncommon issues Thursday.

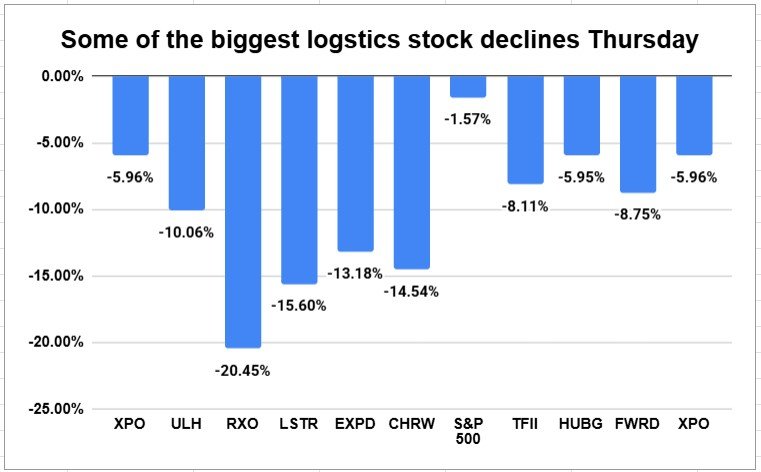

First, its high-flying inventory, pushed partially by investor enthusiasm over the 3PL’s embrace of AI, was one of many logistics firms that fell the toughest that day in a sea of crimson arrows that sucked in trucking corporations as properly. C.H. Robinson inventory was down 14.54% on the day.

(For perspective, C.H. Robinson hit its 52-week excessive on February 6 at $203.34. Its 52-week low was April 9 at $84.68. It closed Thursday at $179.48.)

The second uncommon factor it did was discuss it…type of.

Firms throughout the spectrum are usually reluctant to say something publicly about why their inventory is doing properly or doing poorly. There are many rules on “ahead wanting statements” that firm managements try to make sure they’re in compliance.

The assertion launched by C.H. Robinson (NASDAQ: CHRW) didn’t particularly deal with the dimensions of the inventory value decline. Nevertheless it defended its use of AI and appeared to the longer term, saying the corporate believes continued adoption of AI “will solely proceed to strengthen our efficiency and widen our aggressive moat.”

However in what might be seen as a refined enhance to the house owners of its inventory, the C.H. Robinson assertion mentioned “we stay assured in our technique and proceed to execute on our disciplined share repurchases from the previous yr.”

The large selloff additionally hit two different publicly-traded 3PL firms RXO (NYSE: RXO), whose inventory already had been falling for a yr in contrast to C.H. Robinson, fell greater than C.H. Robinson, down 20.45%. Landstar (NASDAQ: LSTR) declined 15.6%.

Expeditors Worldwide (NYSE: EXPD) fell a whopping 13.18%. Whereas it’s not an over the highway freight dealer like RXO or C.H. Robinson, its enterprise is an asset-light firm that works to get freight from shipper/producer to an finish buyer by way of an ocean or air provider on belongings owned by others.

Though the selloff throughout markets seemed to be directed at firms whose enterprise might be even additional disrupted by AI than what was anticipated already, each logistics and trucking firms felt the sting of the decline.

Among the many trucking firms whose shares took an enormous hit Thursday, TFI Worldwide (NYSE: TFII) was down 8.11%; Ahead Air (NASDAQ: FWRD) fell 8.75%; Werner Enterprises (NASDAQ: WERN) declined 5.34%; Heartland Specific (NASDAQ: HTLD) fell 5.75%.

Among the many larger trucking firms, Previous Dominion (NASDAQ: ODFL) fell 4.6%, J.B. Hunt (NASDAQ: JBHT) declined 5.06% and Knight Swift (NYSE: KNX) declined simply 0.6%.

The S&P 500 fell 1.57% for the day.

Simply earlier than 11 a.m. Friday, a few of these shares had rebounded however solely a fraction of the prior day’s decline. C.H. Robinson was up 3.42%; RXO was up 2.77%; and Landstar rose 0.81%.

The transportation analysis crew at Baird Fairness Analysis sought to determine a purpose for the decline in a broadcast notice.

“The transport advanced has come beneath significant stress this morning for causes that aren’t instantly identifiable,” the corporate mentioned in its analysis notice. “That mentioned, we’d notice that the weak spot seems to be concentrated within the asset-light, technology-enabled brokerage platforms, each in home truck brokerage and worldwide freight forwarding.”

It cited 4 attainable causes for the selloff.

-

An important, Baird mentioned, was “rising debate round open-source automation brokers akin to Molt Bot that provide elevated potential to automate routine back-office duties and assist equalize the know-how taking part in discipline for smaller operators.” The scale benefit of firms like C.H. Robinson would presumably shrink if that have been to happen.

-

“Spot charges seemingly peaking following winter storm Fern and the bomb cyclone earlier than the receipt of tax rebate checks which might be anticipated to be meaningfully increased year-on-year.

-

The Self-Drive Act, which might pace autonomous trucking.

-

And a purpose which may appear counterintuitive: the FMCSA closing rule on non-domiciled CDL holders. Some interpretations of the regulation have concluded that it’ll not cut back capability as shortly as may need been anticipated.

Baird’s notice was primarily to specific skepticism because it reiterated its Outperform score on a number of shares.

“Automation is just not a brand new theme,” Baird mentioned. “The digital brokers automated within the 2010-2015 interval, however service dependability was missing as was their potential to leverage excessive execution predictive analytics. Profitable execution in digital brokerage requires a finest at school knowledge set, constructed over years throughout cycles. Solely the massive tech-enabled gamers like CHRW and EXPD possess that breadth and depth of cargo, pricing, and provider efficiency knowledge to ship. Safety can also be a rising focus.”

An identical analysis notice from the transportation analysis crew at Barclays reiterated its Obese score on C.H. Robinson in addressing the causes for the selloff.

Its notice linked to a tweet from the co-founder at Open Mercato relating to a freight administration system constructed on Open Mercato. Barclays mentioned it believed the promise inherent on this tweet from Tomasz Karwatka was a key driver within the decline in transportation shares, significantly the 3PLs.

Barclays additionally instructed a press launch from Algorhythm Holdings (NASDAQ: RIME) that its SemiCab platform “in dwell buyer deployments” was capable of “scale freight volumes by 300% to 400% with out a corresponding improve in operational headcount” was an element within the selloff.

Algorhythm launched a white paper on its findings along with the press launch. (A hyperlink to the white paper was not useful early Friday).

However Barclays mentioned the important thing disruptor in transportation logistics stays C.H. Robinson.

“We see the strikes in asset-light transportation shares as disproportionate to the danger and could be vital patrons of weak spot, particularly in CHRW shares,” it mentioned.

C.H. Robinson’s assertion repeated a lot of its personal boasts about the place it stands within the cycle of AI adoption. It wrapped up its protection by alluding to its monetary place with out mentioning the inventory value.

“Our management in AI enhances the already robust fundamentals of our firm,” C.H. Robinson mentioned. “We’ve outperformed the freight marketplace for eight consecutive quarters. Our robust stability sheet, liquidity and investment-grade credit standing permit us to repeatedly spend money on innovation, even when rivals can’t, whereas additionally shopping for again our inventory. We’re a dividend aristocrat, returning increased dividends to our traders for 27 consecutive years.”

The publish Logistics inventory selloff Thursday brings assurances of calm appeared first on FreightWaves.