Germany’s Merz Has a Downside: Can He Spend a Trillion Euros?

Funding in infrastructure and navy isn’t easy in a rustic that always struggles to get issues accomplished.

Article content material

(Bloomberg) — German Chancellor-in-waiting Friedrich Merz has locked in political backing for a grand plan to ramp up funding in its infrastructure and navy.

Article content material

Article content material

Now he must spend the cash, and that’s not easy in a rustic that always struggles to get issues accomplished.

Time is of the essence: US President Donald Trump’s rush for peace in Ukraine and his disengagement on protection will rapidly put the onus on Germany and Europe to take up the safety mantle — a process Merz has already acknowledged as vital. And he is aware of too that the area’s largest financial system, already weak to the White Home’s commerce protectionism, can’t afford but extra misplaced years.

Commercial 2

Article content material

However even after painstaking coalition talks conclude in coming weeks, Merz’s achievement of loosening finances guidelines to unleash a debt-fueled spending spree will face a gauntlet of prolonged scrutiny by lawmakers, adopted by bureaucratic decision-making on its implementation, all slowed down by restricted capability.

The incoming chancellor should urgently remodel the German state or else threat that the open fiscal floodgates produce extra of a trickle than a deluge for a lot of his time period. Failure might depart the nation with an insufficient protection deterrent towards Russia, dealing with but extra financial malaise, and will additionally solid a shadow over his push to comprise the far-right AfD.

“It will take time,” stated Werner Gatzer, a former deputy German finance minister who’s now chairman of Deutsche Bahn’s supervisory board and a part of a gaggle advocating measures to streamline authorities. “The cash is offered now. The following step should be reforming the state itself.”

The money hoard that will probably be at Germany’s disposal is often cited at as a lot as €1 trillion ($1.1 trillion). That includes a particular fund of €500 billion for infrastructure after which cash for protection, not restricted by the nation’s debt brake after Merz engineered constitutional modifications requiring extra-large majorities of lawmakers.

Article content material

Commercial 3

Article content material

A stagnant financial system already made such funding fascinating, however Europe’s protection weaknesses create much more of an crucial. Evaluation of the Russian risk by navy planners factors to the necessity for a credible deterrent inside 5 to seven years.

The kick begin to prosperity from a spending spree might be vital. Deutsche Financial institution economists have raised their forecasts for financial progress in 2026 to 1.5% from 1%, reaching a tempo of two% in 2027. That’s consistent with current revisions from Goldman Sachs and Commerzbank.

“After a few years of doom and gloom and in occasions of nice uncertainty, the fiscal bundle could be a actual game-changer for the sentiment within the financial system,” Barclays chief economist Christian Keller stated. “When corporations and buyers see alternatives, they normally seize them.”

However the cash itself might be sluggish to reach: the yr could also be drawing to an in depth by the point the infrastructure fund turns into legislation, and in widespread with different superior economies, massive German initiatives face drawn-out procurement, allowing and planning processes that always eat way more time than precise building.

Commercial 4

Article content material

Implicit within the financial forecasts is a sluggish begin to stimulus, solely reaching its full affect in 2027 — when Merz’s time period of as much as 4 years passes its midway level.

Deutsche Financial institution reckons the infrastructure spend will whole €30 billion in 2026. It could then double to €60 billion in 2027 earlier than falling again to €40 billion in 2028. It initiatives protection outlays to rise from €80 billion to €110 billion in 2026, reaching €150 billion in 2027.

That chimes with the timetable envisaged by Tammo Diemer, co-head of Germany’s finance company that manages the nation’s debt, who sees its necessities from capital markets rising solely “step by step, yr by yr.”

Germany can transfer quick when essential, with essentially the most eminent current instance being the creation of liquid pure fuel terminals in report time after Russia’s invasion of Ukraine endangered power provides.

That was a particular case nevertheless, delivered underneath duress. The nation is extra used to multi-decade sagas, equivalent to the development of Berlin’s Brandenburg airport and the still-unfinished revamp of Stuttgart’s practice station.

Commercial 5

Article content material

Current spending has fallen brief. In 2023, a staggering €76 billion — 16% of Germany’s whole finance plan — went unused as a consequence of hindrances equivalent to bureaucratic hurdles, provide bottlenecks and employees shortages. Areas targeted on by Merz’s push have been notably difficult.

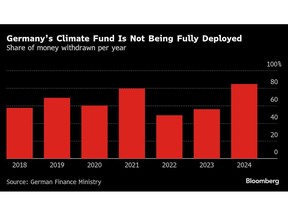

The federal government’s Local weather and Transformation Fund, often called the KTF, which subsidizes initiatives like electrical automobile charging, has solely disbursed about 65% on common up to now seven years. It should obtain €100 billion of the deliberate €500 billion stimulus.

Germany’s €100 billion navy fund, arrange by present Chancellor Olaf Scholz’s coalition, is one other instance. Whereas a lot of the cash has been earmarked for weapon purchases, solely 1 / 4 of it has really been disbursed up to now three years.

One downside there’s a strict postwar regime that prohibits Germany’s arms trade from stockpiling weapons. Stress-free such restrictions might increase manufacturing, stated Monika Schnitzer, chair of the nation’s unbiased council of financial specialists. She additionally reckons producers equivalent to Rheinmetall, Hensoldt and Diehl Protection might poach expertise from the struggling automotive sector.

Commercial 6

Article content material

Labor shortages stay a widespread theme nevertheless, and with a big building workforce wanted for Germany’s infrastructure push from fixing bridges to renovating hospitals and colleges, which may show one other brake on spending.

“If we have a look at the development trade, it’s operating at full capability in the mean time,” stated Ifo Institute President Clemens Fuest. “There are considerations that more cash thrown at them will increase costs.”

What Bloomberg Economics Says…

“Germany’s financial system is structurally weak, because it offers with a shift away from Chinese language demand, increased power prices and a faltering autos trade. Increased funding spending might considerably assist tackle these challenges, smoothing the financial transition and boosting potential GDP by 2% in the long run.”

—Martin Ademmer, economist. For full notice, click on right here

Extra versatile working hours and prioritizing digitalization in public infrastructure administration might assist clear some bottlenecks, in keeping with Stefan Kolev, Director of the Ludwig Erhard Discussion board for Financial system and Society.

He and different economists together with Fuest and Bundesbank President Joachim Nagel say the federal government mustn’t let up on growth-friendly reforms. Nagel, amongst different issues, is urging labor market-oriented migration or incentivizing older folks to work.

Commercial 7

Article content material

Gatzer, whose profession within the finance ministry gave him distinctive insights into Germany’s paperwork, says the LNG success reveals what to concentrate on: limiting appeals, overriding procedural processes and resisting lobbying strain in addition to protests.

“The brand new authorities has a heavy burden of accountability to get this proper,” stated Ulrike Malmendier, a professor on the College of California who, like Schnitzer, is a member of the panel of financial specialists. “Structural reforms must comply with.”

Social Democrat co-leader Lars Klingbeil — a frontrunner to be the following finance minister within the doubtless coalition with Merz’s CDU/CSU — final week pledged a “new spirit” to speed up funding of the €500 billion of particular funds.

“We should be certain that the cash isn’t invested in Germany on the ordinary pace,” he advised public broadcaster ZDF. “All the pieces shouldn’t must be authorized 20 occasions, deliberate 30 occasions, take umpteen years.”

Merz is aware of the stakes, not least after a ballot by Forsa launched final week exhibiting the AfD profitable 24% of the vote — only one level behind his bloc. His consciousness of the second was clear in his announcement, even that includes former European Central Financial institution chief Mario Draghi’s saving-the-euro “no matter it takes” language.

“If this authorities can’t make it occur now…,” stated Gatzer, trailing off as he contemplated the rise of the AfD.

—With help from Alessandra Migliaccio, Alexander Weber, Arne Delfs, Iain Rogers, Michael Nienaber and Petra Sorge.

Article content material