DeepSeek Drives $1.3 Trillion China Inventory Rally as Funds Pile In

(Bloomberg) — DeepSeek’s breakthrough in synthetic intelligence helps drive a rotation of inventory funds again into China from India.

Most Learn from Bloomberg

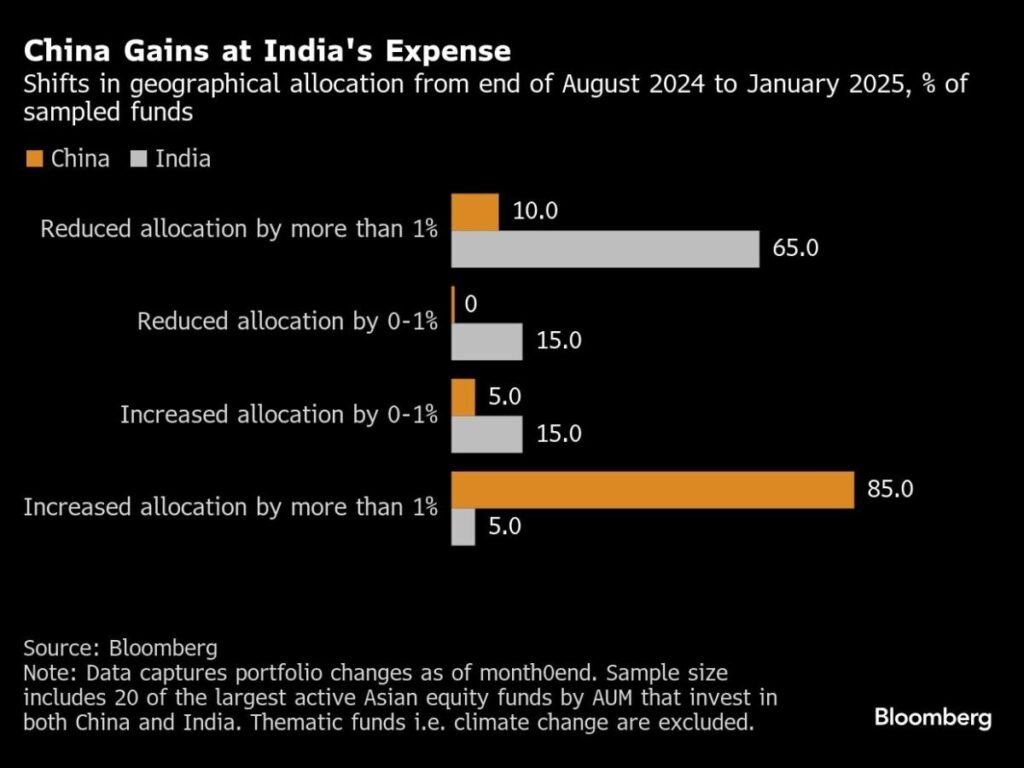

Hedge funds have been piling into Chinese language equities on the quickest tempo in months as bullishness on the DeepSeek-driven expertise rally provides to hopes for extra financial stimulus. In distinction, India is struggling a document exodus of money on considerations over waning macro development, slowing company earnings and costly inventory valuations.

China’s onshore and offshore fairness markets have added greater than $1.3 trillion in complete worth in simply the previous month amid such reallocations, whereas India’s market has shrunk by greater than $720 billion. The MSCI China Index is on monitor to outperform its Indian counterpart for a third-straight month, the longest such streak in two years.

DeepSeek has proven “that China truly has corporations which can be forming an important a part of the entire AI ecosystem,” mentioned Ken Wong, an Asian fairness portfolio specialist at Eastspring Investments. His agency has been including Chinese language web holdings over the previous few months, whereas trimming smaller Indian shares that had “run up well past their valuation multiples.”

The rotation marks an about-face from the pivot into India seen over the previous a number of years, luring funds away from China. That was based mostly on an India’s infrastructure spending splurge and its potential as a substitute manufacturing hub to China. Home-focused India has additionally been seen as a relative haven amid Donald Trump’s tariff plans.

China seems to be regaining its former attraction on a elementary reevaluation of its investability, particularly in tech. After scaring traders with company crackdowns not way back, Beijing may very well assist push the brand new AI theme, as indicated by the information that entrepreneurs together with Alibaba Group Holding Ltd. co-founder Jack Ma have been invited to satisfy the nation’s high leaders.

DeepSeek-related developments are doubtless to assist enhance China’s economic system in addition to its markets, offering an prolonged enhance, mentioned Vivek Dhawan, a fund supervisor at Candriam. “In the event you put all of the items collectively, China turns into extra enticing than India within the present set-up on a risk-reward foundation.”

The valuation differential provides to China’s attract as nicely. The MSCI China Index is buying and selling at simply 11 instances ahead earnings estimates, in contrast with about 21 instances for the MSCI India Index.