Choices Merchants Line Up Hedges Earlier than Pivotal Nvidia Earnings

Even earlier than Friday’s slide jolted the US inventory market out of its calm, some merchants have been getting ready for unrest.

Article content

(Bloomberg) — Even before Friday’s slide jolted the US stock market out of its calm, some traders were preparing for unrest.

Article content

Article content

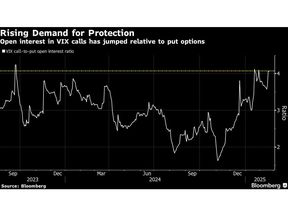

While the S&P 500 Index was hovering near an all-time high and the Cboe Volatility Index was well below its five-year average, under the surface a more skeptical picture was shaping up — one that’s been already vindicated by the biggest selloff in two months. Last week, the ratio of outstanding VIX call options relative to puts neared its highest level since September 2023, with more than 1 million calls changing hands on Tuesday.

Advertisement 2

Article content material

Buyers have began to spice up bets that volatility will come again as Nvidia Corp.’s earnings on Wednesday could possibly be the primary in a whirlwind of occasions with the potential to ship the market into conniptions. Whereas US President Donald Trump’s return to the White Home and his tariffs rhetoric have to this point completed little to spook merchants, warning calls have usually grown louder — from Nomura Holdings Inc.’s Charlie McElligott to Goldman Sachs Group Inc.’s Scott Rubner.

Learn: Merchants Piling Into VIX Name Hedges Elevate Strain on Sellers

“Nvidia definitely appears to have the possibility to maneuver the whole fairness market,” mentioned Brent Kochuba, founding father of choices platform SpotGamma. Extra broadly, “there are lots of catalysts for volatility to spike over the subsequent a number of weeks, together with tariffs and the federal government shutdown deadline,” he added, saying that hedging exercise picked up on Tuesday, when 250,000 VIX name choices have been purchased in two block trades.

Nvidia has greater than tripled from a low in October 2023, turning into a $3.3 trillion behemoth, on optimism over the unreal intelligence sector. The rally has turned it into the second-biggest member of the S&P 500, making the broad market extra weak to the inventory’s gyrations.

Article content material

Commercial 3

Article content material

Since its final earnings report in November, buying and selling within the shares has been uneven, and the January rout triggered by Chinese language AI startup DeepSeek solely added to the issues. As of Friday, choices merchants have been pricing in a 7.7% transfer in Nvidia shares following its earnings, in contrast with a mean achieve or drop of 9.2% after the final eight quarterly stories. The S&P 500 fluctuated a mean 0.8% on these days, greater than its imply each day transfer of 0.6% up to now two years.

“Nvidia earnings and any subsequent volatility can positively have an effect on broader volatility,” mentioned Amy Wu Silverman, head of derivatives technique at RBC Capital Markets. “Any up or draw back shock in Nvidia earnings may have ripple results to AI and AI-adjacent names.”

The chip big is a late comer within the reporting season, with most S&P 500 corporations having already posted outcomes. The releases, which generally make shares transfer extra to their very own tune and fewer to macroeconomic headlines, have helped push a gauge of realized correlation for the 50 largest S&P 500 members close to 0, simply shy of its lowest stage ever. A studying of 1 implies the shares are transferring in sync.

Commercial 4

Article content material

All through that interval, hedge funds have been betting simply on market calm: By way of Feb. 18, they have been close to probably the most net-short VIX futures in seven months, in keeping with the newest obtainable knowledge from the Commodity Futures Buying and selling Fee. The final time the studying was this low, the volatility shock of early August was about to occur.

Past Nvidia, a bunch of catalysts may spur a resurgence of market swings within the coming weeks. The suspension of Trump’s new tariffs to Canada and Mexico is about to run out on March 4. Buyers will get the newest learn on the US jobs knowledge three days later, and March 14 is the deadline to succeed in an settlement that might keep away from a authorities shutdown.

“If actual impactful tariff information have been to be unfavorable throughout the board and shares begin to transfer in tandem or with excessive correlation, then we may definitely see a spike in volatility,” mentioned Chris Murphy, co-head of derivatives technique at Susquehanna Worldwide Group.

—With help from David Marino.

Article content material