Bitcoin ATM scams trick victims into dropping 1000’s

When 85-year-old Chelmsford resident Janice Peltz bought a cellphone name from her financial institution a few fraud problem, she believed them and adopted each instruction they gave.”That was what suckered me in,” Peltz stated.But it surely was not TD Financial institution on the tip of the road; it was a scammer. The scammer, who stored Peltz on the cellphone for hours, directed her to the financial institution, the place she took out $18,000 in money. “He stated, ‘I do not need you to inform anyone. We do not know who was doing this, and we do not know if it is any individual within the financial institution or it could possibly be even any individual you recognize,'” Peltz stated. She then drove to Village Selection in Lowell, the place she deposited the money right into a Bitcoin Depot ATM. She did it one invoice at a time and stated it took round three hours to finish. “Being of an elder age, I did not know what a Bitcoin was,” Peltz stated. “It is nearly like I used to be hypnotized.” As soon as within the machine, the cash was gone, and Peltz was out $18,000, a sum she nonetheless has not recovered, although she is working with police in hopes of getting it again. “It is greater than devastating. For a very long time, I could not cease blaming myself,” Peltz stated.Peltz is one in every of many individuals tricked by a Bitcoin ATM rip-off. Tons of of the machines are scattered throughout the state in comfort shops, gasoline stations and grocery shops. The machines convert money to crypto, and cost charges of as much as 35% to do it. As soon as the cash goes in, it is troublesome to get again, based on Jim Carney, an investigator within the Essex County district legal professional’s workplace. “It is nearly instantaneous, the pace of sunshine that cash, that cryptocurrency can transmit to those dangerous guys’ pockets,” Carney stated.Massachusetts residents have misplaced a minimum of $77 million to Bitcoin ATM scams simply this 12 months, based on Carney. He stated the scammers are primarily working by means of name facilities in different nations, and it is displaying no indicators of slowing down. Massachusetts lawmakers try to stop Bitcoin ATM scams with a invoice that will implement each day transaction limits, refunds for fraud victims and price caps, amongst different measures.AARP is sponsoring the invoice. Jennifer Benson, the group’s Massachusetts director, stated she has seen a “big improve” within the variety of individuals getting scammed by means of Bitcoin ATMs previously 12 months. “It’s the Wild West. It is exhausting to trace down the cash. It is exhausting to get the cash again. And it is utilizing a tool that many individuals really feel accustomed to as a result of they use ATMs on a regular basis,” Benson stated.At the very least two Massachusetts cities, Waltham and Gloucester, have banned Bitcoin ATMs fully. The invoice underwent a public listening to final month, throughout which representatives of CoinFlip and Bitcoin Depot testified. The businesses function a lot of the Bitcoin ATMs throughout the state. “We’ve severe issues with sure provisions that characterize an efficient ban on a brand new trade because of the overly aggressive nature of the boundaries on each day transactions and unreasonably low price cap provisions,” Ethan McClelland, director of presidency relations for Bitcoin Depot, stated throughout the listening to.When requested for an interview, the corporate despatched a press release, saying partly, “Tons of of individuals in Massachusetts use Bitcoin Depot kiosks legitimately each month, from sending cash to household to soundly shopping for small quantities of Bitcoin for the primary time. Many want in-person, cash-based transactions as a result of they’re easy, accessible, and supply fast entry.A CoinFlip spokesperson stated in a press release, “We maintain ourselves to the best requirements of client safety, compliance, and transparency. CoinFlip by no means needs to revenue when sincere persons are duped by dangerous actors, which is why we refund transaction charges to victims in situations of fraud.”TD Financial institution stated in a press release, “Whereas we can’t touch upon particular preventative measures for safety causes, TD supplies shoppers with a variety of useful sources, together with supplies posted on-line and in our shops, to equip them with the data and know-how to detect and keep away from scams which have gotten more and more subtle throughout the worldwide monetary trade.”The invoice at present sits with the Joint Committee on Monetary Providers.

When 85-year-old Chelmsford resident Janice Peltz bought a cellphone name from her financial institution a few fraud problem, she believed them and adopted each instruction they gave.

“That was what suckered me in,” Peltz stated.

But it surely was not TD Financial institution on the tip of the road; it was a scammer.

The scammer, who stored Peltz on the cellphone for hours, directed her to the financial institution, the place she took out $18,000 in money.

“He stated, ‘I do not need you to inform anyone. We do not know who was doing this, and we do not know if it is any individual within the financial institution or it could possibly be even any individual you recognize,'” Peltz stated.

She then drove to Village Selection in Lowell, the place she deposited the money right into a Bitcoin Depot ATM. She did it one invoice at a time and stated it took round three hours to finish.

“Being of an elder age, I did not know what a Bitcoin was,” Peltz stated. “It is nearly like I used to be hypnotized.”

As soon as within the machine, the cash was gone, and Peltz was out $18,000, a sum she nonetheless has not recovered, although she is working with police in hopes of getting it again.

“It is greater than devastating. For a very long time, I could not cease blaming myself,” Peltz stated.

Peltz is one in every of many individuals tricked by a Bitcoin ATM rip-off.

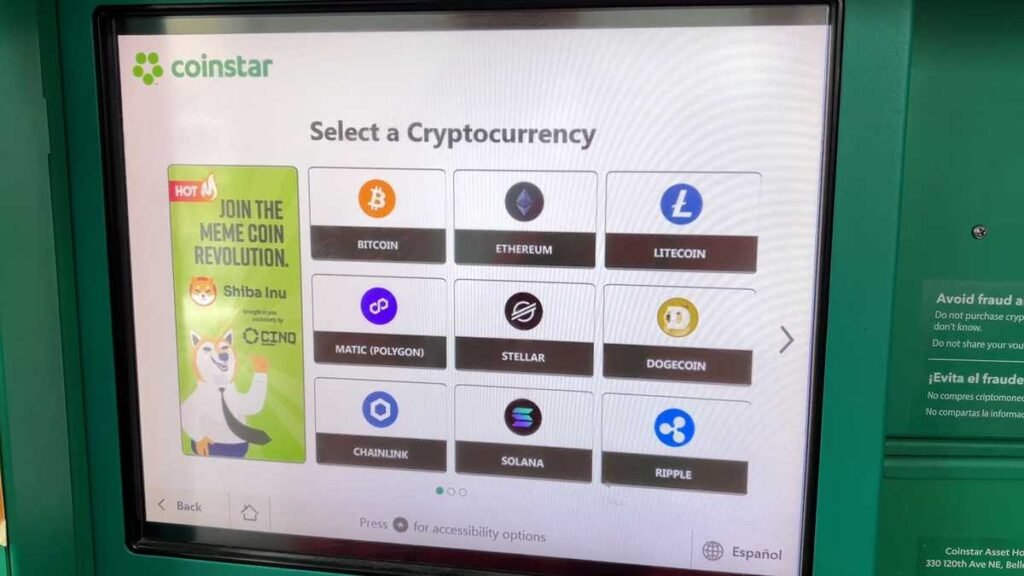

Tons of of the machines are scattered throughout the state in comfort shops, gasoline stations and grocery shops. The machines convert money to crypto, and cost charges of as much as 35% to do it.

As soon as the cash goes in, it is troublesome to get again, based on Jim Carney, an investigator within the Essex County district legal professional’s workplace.

“It is nearly instantaneous, the pace of sunshine that cash, that cryptocurrency can transmit to those dangerous guys’ pockets,” Carney stated.

Massachusetts residents have misplaced a minimum of $77 million to Bitcoin ATM scams simply this 12 months, based on Carney. He stated the scammers are primarily working by means of name facilities in different nations, and it is displaying no indicators of slowing down.

Massachusetts lawmakers try to stop Bitcoin ATM scams with a invoice that will implement each day transaction limits, refunds for fraud victims and price caps, amongst different measures.

AARP is sponsoring the invoice. Jennifer Benson, the group’s Massachusetts director, stated she has seen a “big improve” within the variety of individuals getting scammed by means of Bitcoin ATMs previously 12 months.

“It’s the Wild West. It is exhausting to trace down the cash. It is exhausting to get the cash again. And it is utilizing a tool that many individuals really feel accustomed to as a result of they use ATMs on a regular basis,” Benson stated.

At the very least two Massachusetts cities, Waltham and Gloucester, have banned Bitcoin ATMs fully.

The invoice underwent a public listening to final month, throughout which representatives of CoinFlip and Bitcoin Depot testified. The businesses function a lot of the Bitcoin ATMs throughout the state.

“We’ve severe issues with sure provisions that characterize an efficient ban on a brand new trade because of the overly aggressive nature of the boundaries on each day transactions and unreasonably low price cap provisions,” Ethan McClelland, director of presidency relations for Bitcoin Depot, stated throughout the listening to.

When requested for an interview, the corporate despatched a press release, saying partly, “Tons of of individuals in Massachusetts use Bitcoin Depot kiosks legitimately each month, from sending cash to household to soundly shopping for small quantities of Bitcoin for the primary time. Many want in-person, cash-based transactions as a result of they’re easy, accessible, and supply fast entry.

A CoinFlip spokesperson stated in a press release, “We maintain ourselves to the best requirements of client safety, compliance, and transparency. CoinFlip by no means needs to revenue when sincere persons are duped by dangerous actors, which is why we refund transaction charges to victims in situations of fraud.”

TD Financial institution stated in a press release, “Whereas we can’t touch upon particular preventative measures for safety causes, TD supplies shoppers with a variety of useful sources, together with supplies posted on-line and in our shops, to equip them with the data and know-how to detect and keep away from scams which have gotten more and more subtle throughout the worldwide monetary trade.”

The invoice at present sits with the Joint Committee on Monetary Providers.