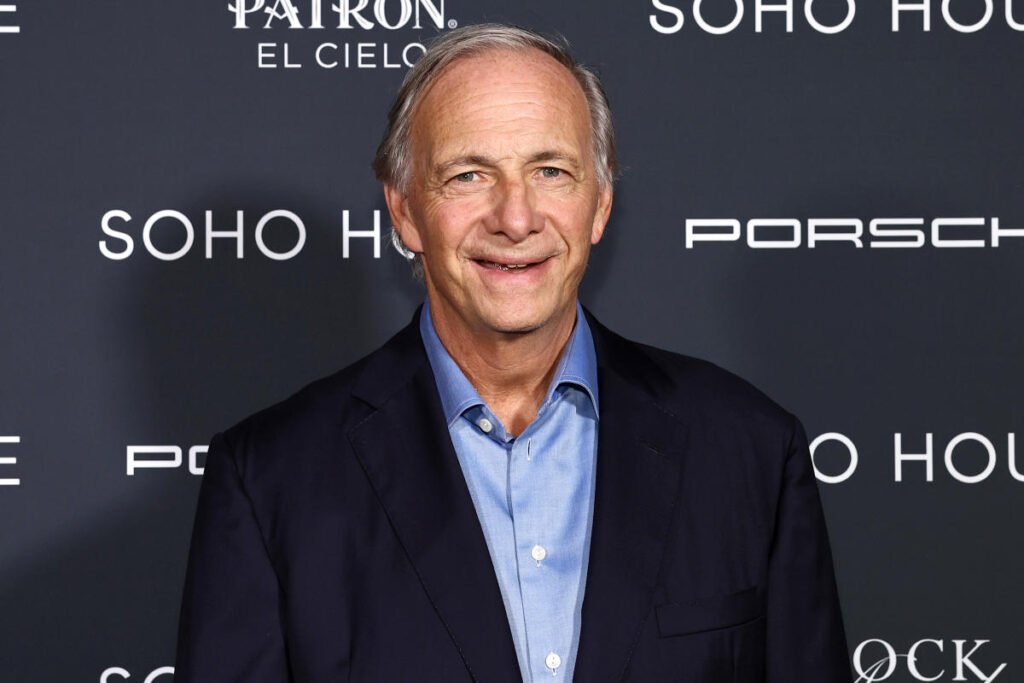

Billionaire Ray Dalio gives contemporary tips about be a greater investor

Pay attention and subscribe to Opening Bid on Apple Podcasts, Spotify, or wherever you discover your favourite podcasts.

If you happen to’re following the new shares of the second — such because the Magnificent Seven — it’s probably been a rush to observe them rise.

Nevertheless, “I believe it’s very very like the web and the dot-com interval,” cautioned Bridgewater Associates founder Ray Dalio throughout a dialog with Yahoo Finance Govt Editor Brian Sozzi for the Opening Bid podcast (see the video above or hear beneath). The pair sat down to speak on the World Financial Discussion board in Davos, Switzerland, and Dalio delivered insights starting from management to his private investing mantras.

Dalio has the advantage of 5 many years of market hindsight. He based Bridgewater in 1975 and grew the corporate from a scrappy operation that he ran out of a two-bedroom residence right into a agency that Fortune ranked because the fifth-most-important personal firm within the US.

Identified within the business for sticking to a bespoke set of rules and sharing them extensively, Dalio is the creator of a number of books on the topic. His newest ebook, “How International locations Go Broke: Rules for Navigating the Huge Debt Cycle, The place We Are Headed, and What We Ought to Do,” is anticipated in September.

Slightly than piling the whole lot into the new inventory of the day, Dalio suggested buyers to think about extra diversification by investing in 10 to fifteen “good, uncorrelated return streams which are danger balanced.” Calling this technique his “holy grail and … mantra in investing,” he informed Sozzi, “If you happen to obtain this mantra, you’ll make a fortune.”

“All people’s enthusiastic about what’s the finest debt,” he continued. “They don’t understand that with diversification, the primary three diversified, comparatively uncorrelated property will scale back the chance virtually in half. Meaning you double your return-to-risk ratio.”

Dalio additionally suggested that one of these technique typically requires endurance upon deployment, which might show tough in a buzz-generation atmosphere. “The sport is performed on not getting out,” he mentioned. “The character of loss [is], you lose 50%, it’s a must to make 100% to get it again.”

For the evergreen investor with $1,000 to speculate, Dalio suggested reflecting on the distinction between alpha and beta.

“Alpha is a zero-sum recreation,” he mentioned. “To get alpha, it’s a must to take it away from any person else. Beta means there’s an asset class.”

However even earlier than diversification, his first tip for buyers is to be humble.

“Be humble, like in any recreation [where] you’re competing,” he mentioned.

His remaining tip is to judge the headline- and buzz-generating investments. “Get away from the notion that investments which have completed nicely lately are higher investments, moderately than costlier. You must know the distinction between an funding that has gone up so much and [that’s] completed nicely.”