ECB cuts rate of interest to 2.5%

Unlock the Editor’s Digest without cost

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

The European Central Financial institution has diminished its benchmark rate of interest by a quarter-point to 2.5 per cent, because it signalled a potential slowdown in cuts to borrowing prices.

Thursday’s extensively anticipated transfer is the sixth discount within the ECB’s deposit charge because the central financial institution began its rate-cutting cycle final June, when the benchmark stood at a file excessive of 4 per cent to counter surging inflation.

In a change of tone that indicators a extra hawkish stance, the ECB mentioned that “financial coverage is changing into meaningfully much less restrictive”.

The language prompt a potential slowdown or pause in future rate of interest cuts, because it in contrast with the ECB’s earlier wording that “financial coverage stays restrictive”.

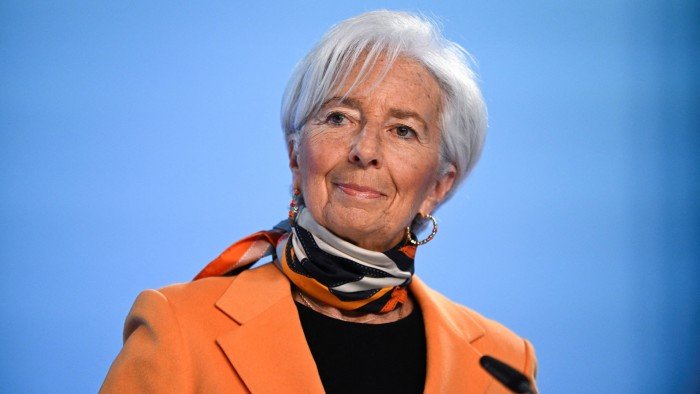

Christine Lagarde, ECB president, mentioned that the shift in wording was “not an innocuous little change”. Lagarde raised the prospect of pausing the ECB’s run of charge cuts, saying rate-setters could be led by what “the info signifies”.

Lagarde additionally mentioned that there was no opposition to the choice to chop charges — although one rate-setter, Austria’s hawkish central financial institution governor Robert Holzmann, abstained.

Within the instant aftermath of the choice, merchants trimmed their bets on future charge reductions.

Whereas they continued to totally worth in a single additional quarter-point lower this yr, in keeping with ranges implied by swaps markets, the possibility of a second lower in 2025 fell from round 85 per cent to roughly 60 per cent.

The euro rose towards the greenback after the ECB resolution, up 0.5 per cent at $1.085.

“The ECB’s course of journey is now not that clear,” Carsten Brzeski at ING wrote in a word to shoppers, pointing to the change in wording.

Inflation has fallen from a peak of 10.6 per cent in October 2022 to 2.4 per cent in February and the deposit charge is now at its lowest since February 2023.

The prospects for the Eurozone economic system may be affected by strikes by Friedrich Merz, Germany’s chancellor-in-waiting, to unleash a whole lot of billions of euros in borrowing to spice up defence spending and overhaul his nation’s infrastructure.

Some analysts forecast that the plans might double Germany’s anticipated development subsequent yr to 2 per cent.

German debt, the Eurozone benchmark, misplaced a bit of extra floor after the ECB resolution, following a pointy sell-off after the nation’s historic stimulus announcement. That pushed 10-year Bund yields up 0.1 share factors at 2.89 per cent.

In projections that didn’t consider Merz’s announcement this week, the ECB lower its development forecast for 2025 — its sixth successive downgrade for the yr — in addition to for 2026 and 2027.

It now expects Euro space GDP to extend by solely 0.9 per cent this yr, in contrast with its December projection of 1.1 per cent.

“Excessive uncertainty, each at dwelling and overseas, is holding again funding and competitiveness challenges are weighing on exports,” Lagarde mentioned on Thursday afternoon, including that rate-setters had been dealing with an acutely unsure surroundings. Development final yr was a sluggish 0.7 per cent.

However Lagarde added that “a rise in defence and infrastructure spending might additionally add to development” and “might additionally increase inflation via its results on combination demand”.

Forward of the ECB resolution, Goldman Sachs economists wrote in a word to shoppers that Germany’s debt-funded push for a lot greater defence spending and infrastructure funding “clearly lowers the strain” for the ECB to chop rates of interest under 2 per cent.

The ECB raised its forecast for inflation this yr from its December estimate of two.1 per cent to 2.3 per cent on the again of upper vitality costs.

It added that “most measures of underlying inflation” prompt that it remained on observe to satisfy its 2 per cent goal.

Pooja Kumra, a charges strategist at TD Securities, mentioned the ECB was “definitely extra cautious” on future cuts, as she alluded to US President Donald Trump’s threatened tariffs on the EU.

“With uncertainty round fiscal [policy] and tariffs, they can’t decide to any path,” she mentioned.

“We predict if inflation and development information come consistent with expectations over the approaching months, the ECB is prone to lower another time to 2.25 per cent in April, earlier than pausing in June when the fiscal and tariff affect turns into clearer,” mentioned Neil Mehta, portfolio supervisor at RBC BlueBay Asset Administration.