Demand for Japanese bonds reassures jittery markets

Unlock the Editor’s Digest without spending a dime

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

Sturdy demand for Japanese authorities bonds helped to regular Asian markets on Tuesday, a day after hawkish feedback from the central financial institution governor sparked a world sell-off.

The yen steadied and fairness markets had been flat, with traders reassured by demand at an public sale of Japanese authorities bonds. The benchmark Nikkei 225 and the broader Topix each closed up 0.1 per cent, whereas the yen weakened 0.1 per cent towards the greenback.

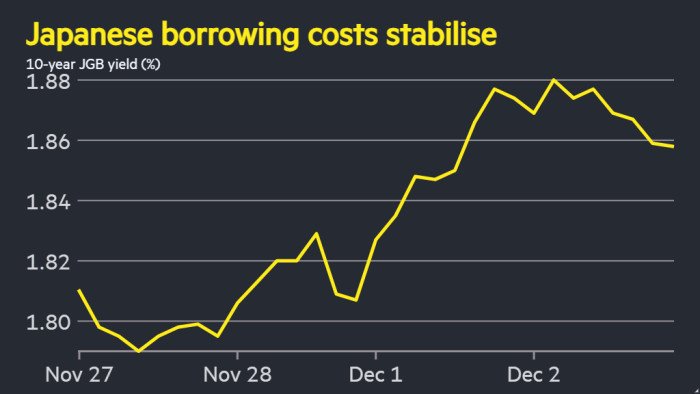

The public sale of 10-year Japanese bonds attracted comparatively strong demand, together with from pension funds, helped by the yield of 1.88 per cent on the benchmark word — a 17-year excessive — instantly previous to the public sale.

The public sale was held a day after feedback from Financial institution of Japan governor Kazuo Ueda instructed to traders that the central financial institution was prepared to boost rates of interest this month for the primary time in virtually a yr.

“The market appears to suppose that [a rate increase in December] is just about a performed deal,” stated Shoki Omori, chief desk strategist at Mizuho.

The renewed hypothesis round a possible BoJ fee improve drove shares in Japan’s largest banks increased. Shares in MUFG, the nation’s largest lender, rose 2.5 per cent on Tuesday, whereas shares in its closest rival, SMFG, ended the day 3 per cent increased.

The yen’s persevering with weak spot towards the US greenback, stated analysts, will improve the probabilities of a BoJ transfer in December.

“We’ve got a scenario the place the Japanese ministry of finance has signalled that it’s standing by to intervene to prop up the yen if wants be, and now we have indicators that small and medium-sized companies are feeling the ache from excessive enter prices due to the weak foreign money,” stated Neil Newman, Japan strategist at Astris Advisory. “I feel the BoJ has to go for it in December.”

Ueda’s feedback pushed yields on Japanese authorities debt to multiyear highs — yields transfer inversely to costs — and triggered declines in different bond markets all over the world. Increased yields on safer belongings contributed to a fall of greater than 5 per cent within the value of bitcoin.

The current sharp strikes in JGB yields, coupled with the regular slide within the yen within the two months since Sanae Takaichi took over as prime minister, have fuelled hypothesis of an unwinding of the so-called yen carry commerce. The carry commerce refers back to the technique of cheaply borrowing yen to finance investments in different belongings.

However Benjamin Shatil, senior economist at JPMorgan, stated that there didn’t seem like any fast catalyst for such an unwind and that low volatility within the yen meant that it was attainable traders had been nonetheless placing extra yen carry trades on.

Elsewhere in Asia, the Grasp Seng was flat whereas China’s CSI 300 rose 0.5 per cent. Korea’s Kospi rose 1.7 per cent.