AI positive factors and robust earnings help Wall Road as tariff woes linger

By Saqib Iqbal Ahmed

NEW YORK (Reuters) -With greater than half of second quarter earnings reported and shares close to report highs, firm outcomes have reassured buyers in regards to the synthetic intelligence commerce that has energized Wall Road, even when tariff worries curtailed shopping for.

With ends in from 297 of the S&P 500 firms as of Thursday, year-on-year earnings development for the second quarter is now estimated at 9.8%, up from 5.8% estimated development on July 1, in line with LSEG knowledge.

Subsequent week buyers will get a peek at earnings from Dow Jones Industrial Common constituents Disney, McDonald’s and Caterpillar, for a have a look at the broader financial system. Robust revenue experiences for these firms might propel the Dow, buying and selling simply shy of its December report excessive, to a contemporary peak.

Some 81% of the businesses have overwhelmed analyst expectations on earnings, above the 76% common for the previous 4 quarters.

“The earnings season has been unambiguously higher than anticipated,” Artwork Hogan, chief market strategist at B. Riley Wealth in Boston, mentioned.

The power of company earnings is especially reassuring for buyers after the pummeling sentiment took within the prior quarter because of the twin threats of tariffs and worries over flagging financial development.

“The primary quarter was a bit extra combined and also you had some questionable financial knowledge … which I believe gave the market some pause,” mentioned Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder in New York.

“However the second quarter appears to have simply been a turnaround,” Ghriskey mentioned.

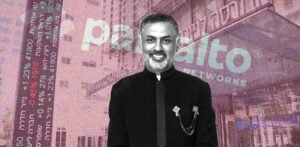

The power of outcomes for names linked to the synthetic intelligence commerce – the funding thesis that AI might be a transformative pressure, driving a good portion of future financial development and firm earnings – is especially heartening, buyers and analysts mentioned.

“General it has been mega caps, development/know-how/AI that’s driving quite a lot of the outcomes,” Ghriskey mentioned.

“That is the place we wish to be uncovered by way of firms … we’re at most fairness exposures and we’re comfy there.”

Having boosted the marketplace for a number of quarters, the commerce bumped into tough waters at first of the 12 months because the emergence of Chinese language-founded synthetic intelligence startup DeepSeek rattled buyers, stoking issues over heightened competitors that would disrupt the dominance of established tech giants on the coronary heart of the AI commerce, together with Nvidia.

Robust outcomes from Microsoft and Meta Platforms reassured buyers that large bets on AI are paying off.