₹1,959.98 crore affect: Arun Khurana steps down as IndusInd Financial institution Deputy CEO with quick impact

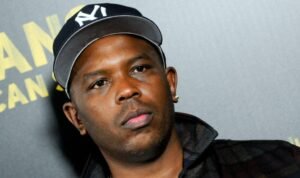

IndusInd Financial institution introduced resignation of Deputy CEO Arun Khurana following the disclosure of accounting discrepancies resulting in a ₹1,959.98 crore affect on the financial institution’s earnings.

In gentle of the current accounting points associated to inner spinoff trades, “I having oversight of the Treasury Entrance workplace perform, as the entire time director, Deputy CEO and part of senior administration of the financial institution, hereby resign, efficient instantly,” Khurana wrote in a letter to IndusInd Financial institution’s board that was included in a inventory market submitting.

“Pursuant to Regulation 30, Schedule III, Half A, Para A(7C) and different relevant provisions of the SEBI (Itemizing Obligations and Disclosure Necessities) Laws, 2015 as amended, we hereby inform that Mr. Arun Khurana, Entire-time Director (Government Director) & Dy. CEO, Key Managerial Personnel of the Financial institution, has by his letter dated April 28, 2025, resigned with quick impact,” the submitting learn.

IndusInd Financial institution, by means of an official disclosure to inventory exchanges on April 27, confirmed that an impartial skilled agency, appointed by its Board of Administrators, submitted its investigative report on April 26. The agency’s report validated the cumulative adversarial accounting affect of ₹1,959.98 crore on the financial institution’s Revenue and Loss account as of March 31, 2025, carefully aligning with the determine earlier disclosed on April 15.

In accordance with the report, the discrepancies had been primarily stemmed from the wrong accounting of inner spinoff trades particularly throughout early terminations. These practices led to the untimely recognition of notional earnings, marking the principal root reason behind the monetary misstatements. It additionally evaluated the roles and actions of key workers concerned.

“The board is taking vital steps to repair accountability of the individuals answerable for these lapses and re-align roles and obligations of senior administration,” the financial institution knowledgeable the bourses.

IndusInd Financial institution has already discontinued all inner spinoff buying and selling actions from April 1, 2024. Moreover, the resultant monetary affect might be duly mirrored within the financial institution’s FY24-25 monetary statements, alongside measures to fortify inner controls.